Check out every thing you have to know about insolvency, from its definition to how organizations and people today can navigate insolvency issues legally and successfully.

Precisely what is Insolvency?

Insolvency refers to the economic affliction where by somebody or business enterprise is not able to satisfy its debt obligations since they develop into because of. To put it simply, this means not owning plenty of income or belongings to pay for back creditors punctually.

This situation can occur thanks to various good reasons including poor dollars flow management, unforeseen fees, or drop in enterprise income. Insolvency can induce authorized penalties and infrequently causes official proceedings like personal bankruptcy or restructuring.

Insolvency vs Bankruptcy: Knowing the main difference

Though usually utilized interchangeably, insolvency and individual bankruptcy are distinct ideas:

Insolvency is a money state indicating The shortcoming to pay debts. - Bankruptcy is actually a authorized process initiated when insolvency contributes to courtroom intervention to solve remarkable debts.

Insolvency may be the issue, while individual bankruptcy is really a lawful cure or consequence of prolonged insolvency.

Forms of Insolvency

Insolvency is broadly categorized into two primary kinds:

one. Funds Circulation Insolvency

Occurs when anyone or enterprise are unable to shell out debts as they appear thanks, Inspite of obtaining belongings that could exceed liabilities. This is the liquidity difficulty — cash isn’t readily available when required.

2. Stability Sheet Insolvency

Transpires when full liabilities exceed total assets, indicating damaging net value. Even if recent hard cash flow is fine, General financial debt load surpasses what could be paid off by offering assets.

Typical Leads to of Insolvency

Insolvency can arise from An array of things impacting funds movement or the general money wellbeing of an entity. Some common results in involve:

Inadequate Financial Management: Inadequate budgeting, forecasting, or expenditure controls can result in money shortages.Economic Downturns: Economic downturn or market place changes may possibly reduce revenues or enhance costs unexpectedly. Abnormal Personal debt: Substantial leverage will make personal debt repayments unsustainable. Operational Inefficiencies: Very low efficiency or weak cost Manage effect profitability. Unforeseen Occasions: Organic disasters, lawsuits, or main products failures disrupt organization operations. - Changes in Market Desire: Shifts in buyer Tastes or Level of competition may well lessen revenue.

The Insolvency Process Spelled out

When insolvency is recognized, people today and firms should make your mind up the most effective course of action to handle credit card debt and secure their interests. The insolvency method commonly involves numerous critical ways:

- Evaluation: Assess economic placement like property, liabilities, and income circulation.

Consultation: Seek advice from financial experts or insolvency practitioners to explore options.Negotiation: Try to renegotiate debts with creditors to concur on revised payment terms. Formal Insolvency Proceedings: If renegotiation fails, authorized procedures for example individual bankruptcy, liquidation, or administration can be initiated. Resolution: Based on the picked out method, property may be offered, debts restructured, or perhaps the company wound up.

Lawful Framework Bordering Insolvency

Most countries have certain legislation governing insolvency to equilibrium the pursuits of debtors and creditors. These laws offer mechanisms to either:

- Permit restructuring or rehabilitation of insolvent organizations to continue functions,

- Or aid orderly liquidation to pay creditors from remaining assets.

Samples of insolvency-linked guidelines involve individual bankruptcy acts, company insolvency codes, and credit card debt recovery tribunals. These laws also control the appointment of insolvency practitioners and outline creditor legal rights.

Choices for Resolving Insolvency

Folks and companies struggling with insolvency have many alternatives based on their instances:

1. Credit card debt Restructuring

This entails negotiating with creditors to change conditions for example desire charges, payment schedules, or credit card debt quantities to create repayment manageable.

2. Informal Preparations

Sometimes debtors workout informal agreements with creditors devoid of involving courts or insolvency practitioners.

three. Official Insolvency Procedures

Personal bankruptcy: For people, this legally discharges debts immediately after court docket-supervised proceedings. Company Voluntary Arrangement (CVA): Makes it possible for corporations to restructure debts when continuing functions. Administration: A temporary procedure exactly where an appointed administrator attempts to rescue the corporation.Liquidation: The entire process of offering an organization’s belongings to pay creditors, ordinarily resulting in enterprise closure.

Influence of Insolvency on Businesses

Insolvency may have severe outcomes for organizations together with:

- Loss of Management over firm functions when directors are appointed.

- Harm to track record impacting associations with prospects and suppliers.

- Employee layoffs or salary delays on account of economical constraints.

- Danger of closure or liquidation leading to complete loss of expenditure.

Having said that, insolvency procedures like administration or restructuring can in some cases help companies recover and return to profitability if managed effectively.

Effects of Insolvency on People today

For people, insolvency usually results in bankruptcy or credit card debt relief programs, that may have the next consequences:

- Authorized limits on acquiring further credit rating or financial loans for many many years.

- Probable loss of property based on the jurisdiction’s personal bankruptcy rules.

- Adverse influence on credit scores and foreseeable future financial standing.

- Opportunity to be discharged from specified debts and begin fresh new.

How to stop Insolvency

Prevention is a lot better than get rid of. Below are a few simple methods to prevent insolvency:

Keep Correct Economic Information: Routinely track income, expenses, and debts. - Hard cash Move Management: Ensure timely invoicing and Charge of outgoing payments.

Program for Contingencies: Have reserves or credit rating lines for unanticipated bills. Request Early Tips: Consult with economic advisors at first signs of issues. Negotiate with Creditors: Proactively handle repayment issues in advance of they escalate.

Position of Insolvency Practitioners

Insolvency practitioners are certified gurus who manage insolvency situations. Their obligations include things like:

- Examining the economical situation from the insolvent entity.

- Advising on achievable answers and legal methods.

- Administering insolvency procedures which include liquidation or restructuring.

- Guaranteeing reasonable treatment method of creditors and compliance with rules.

Summary

Insolvency is a complex but crucial money principle that affects both of those persons and organizations. Knowing its results in, sorts, and resolution possibilities might help navigate tricky monetary cases efficiently.

When insolvency might have significant outcomes, well timed motion, expert suggestions, and ideal lawful procedures can generally give a pathway to Restoration or orderly closure. For those who or your online business is experiencing insolvency, consulting an experienced insolvency practitioner early will make an important change in the result.

here

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Shannon Elizabeth Then & Now!

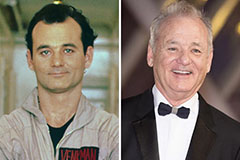

Shannon Elizabeth Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!